NFT (Nutrient Film Technique) is one of the most extensively used hydroponic systems these days. This method is effortless to use, needs very negligible maintenance and can be performed by beginners, professionals and hobbyists.

NFT (Nutrient Film Technique) is one of the most extensively used hydroponic systems these days. This method is effortless to use, needs very negligible maintenance and can be performed by beginners, professionals and hobbyists.

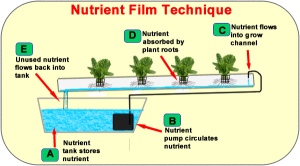

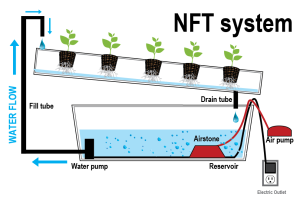

This method involves immersing roots of hydroponics plants in a slender ‘film’ of streaming water in which nutrients or minerals are incorporated. The nutrient solution is impelled through growing tray and it gushes over the roots. NFT is helpful in growing several fruits & vegetables. Leafy vegetables grow particularly well in this method. Some of the extensively produced leafy vegetables with the assistance of NFT in the hydroponic systems are:

Bok Choy – also known as ‘Chinese Cabbage' Bok Choy is a tasty and exotic vegetable. It’s an affluent supply of fiber and vitamin C. when cultivated employing NFT method, taste of Bok Choy doubles.

Cabbage – cabbage grows wonderfully well in hydroponic systems, and NFT is an ideal technique for leafy cabbages. Cabbage has huge amount of foliate and is affluent in protein. Cabbage has a unique taste which’s why it’s employed in numerous Indian and Chinese dishes. This taste can be deepened with the aid of NFT. Utilize higher amount of nutrients such as phosphors and potassium in the nutrient layer. It’ll assist you produce fresh, crunchy, and wholesome cabbage.

Spinach – spinach grows very well in NFT technique. Spinach is one of the most wholesome vegetables and is suggested by several dieticians and doctors because it holds vitamin A, C, E, and K. It’s affluent in iron content also. Spinach can be cooked as gravy or can be employed in quiche, salads, and lasagna. Utilization of iron rich in nutrients in Nutrient Film Technique will aid you grow healthier and greener spinach.

Spinach – spinach grows very well in NFT technique. Spinach is one of the most wholesome vegetables and is suggested by several dieticians and doctors because it holds vitamin A, C, E, and K. It’s affluent in iron content also. Spinach can be cooked as gravy or can be employed in quiche, salads, and lasagna. Utilization of iron rich in nutrients in Nutrient Film Technique will aid you grow healthier and greener spinach.

A correct installation of NFT system is based on employing appropriate channel slope, perfect flow speed, and appropriate channel length. Plan growth is reliant on plenty of water, air and nutrients and NFT, due to its design, offers these 3 essentials to plants successfully.

The agricultural investments require higher initial expense from the side of investor; it requires comparatively higher expense to set up the facilities and growing atmosphere, which in turn brings good returns within a very short period. What if you aren’t an accredited investor, or don’t have enough time and to invest your hard earned money directly in to the modern farming; there are many alternative asset investment management firms which help you to choose exchange-traded funds or mutual funds.

The agricultural investments require higher initial expense from the side of investor; it requires comparatively higher expense to set up the facilities and growing atmosphere, which in turn brings good returns within a very short period. What if you aren’t an accredited investor, or don’t have enough time and to invest your hard earned money directly in to the modern farming; there are many alternative asset investment management firms which help you to choose exchange-traded funds or mutual funds.